Understand How the Economy Works in 6 Simple Steps

The economy is a system and breaking it down into smaller pieces can help you understand it.

In 2007 Ray Dalio, who is one of the most successful hedge fund managers of all time, started sounding alarms that the financial industry was in major trouble. With examples and case studies of economic cycles throughout history, he warned investors, financial institutions, and even the White House.

As he predicted the financial crisis in 2008 impacted the world. His knowledge of what was happening was better than many economists, investors, and even policymakers.

Since then he has written about how the economy works so anyone can better identify the swings and cycles that many miss. Dalio believes that his template has helped him for over 40 years build one of the largest hedge funds in the world and avoid economic downturns.

In this article, I'm going to break down his perspective and highlight how the most basic parts of the economy build to create bigger cycles and how we can all understand the economy in a simple way.

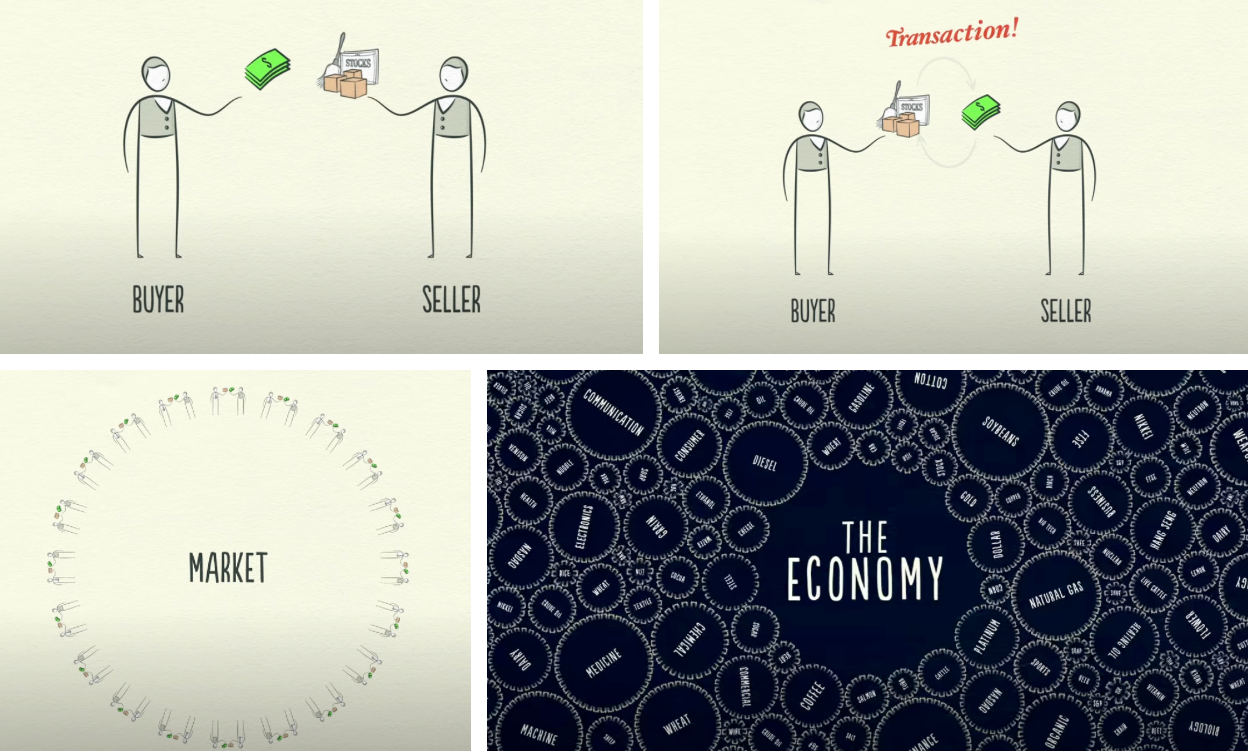

Step #1 Understand How Transactions Make Up the Economy

Dalio argues that the economy works like a machine, and if you can understand the simple parts of that machine, you can understand the larger economy as a whole.

It all starts with transactions.

Every transaction consists of a buyer and a seller. The seller will sell goods, services, or financial assets for money or credit.

All the transactions for a product or service create a market. There are many markets such as a car market, stock market, lemon market, etc. All the markets together create the economy.

Let’s use an example of a lemonade stand since it's a simple representation. In your lemonade stand, you are the seller and the buyer is anyone who buys lemonade from you. The money they give you is now part of your income.

You can now use this income to become a buyer and buy more lemons, groceries, or whatever you want. The money you spend is now part of someone else’s income and they can do the same. This cycle repeats itself over and over.

Step #2 Understand Prices and Productivity

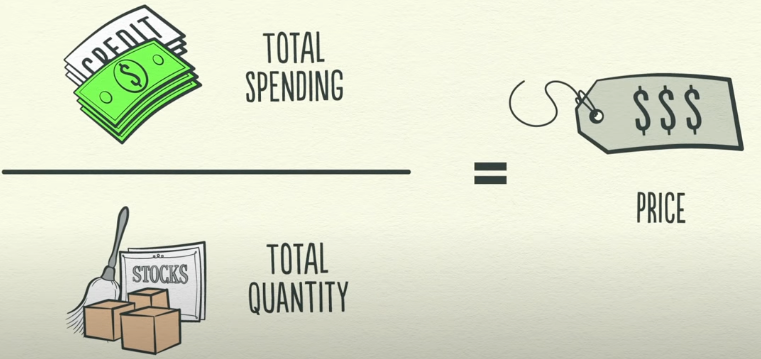

In any given market, when total spending is high compared to the number of goods within that market, prices go up. This is called inflation.

When spending is low compared to the number of goods within that market, prices drop. This is called deflation.

The more productive we are (creating goods) and the more we exchange with each other (buy and sell goods) that drives the economy. Over time we accumulate knowledge and that raises our living standards.

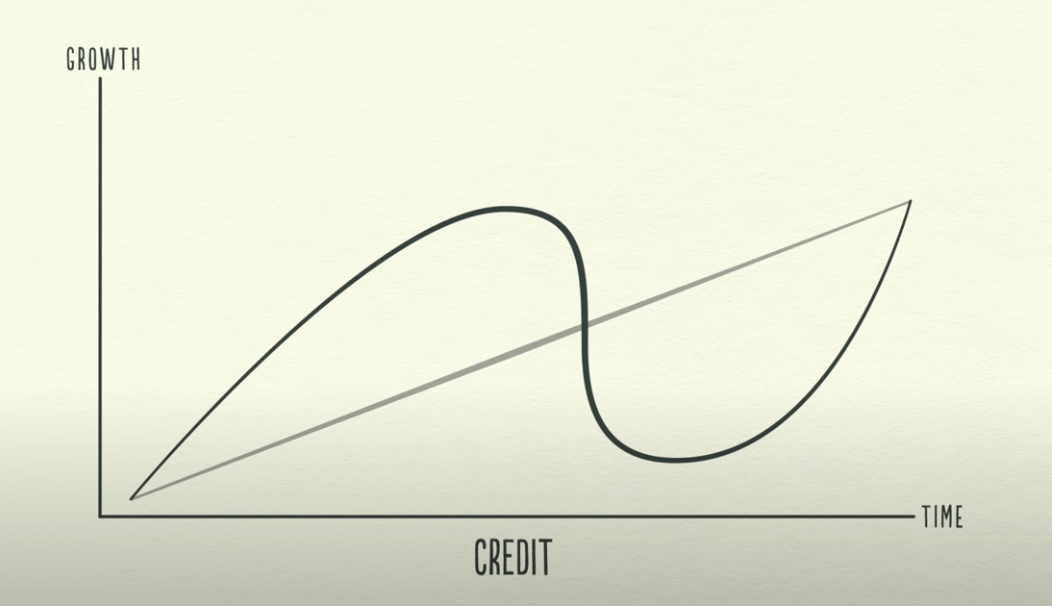

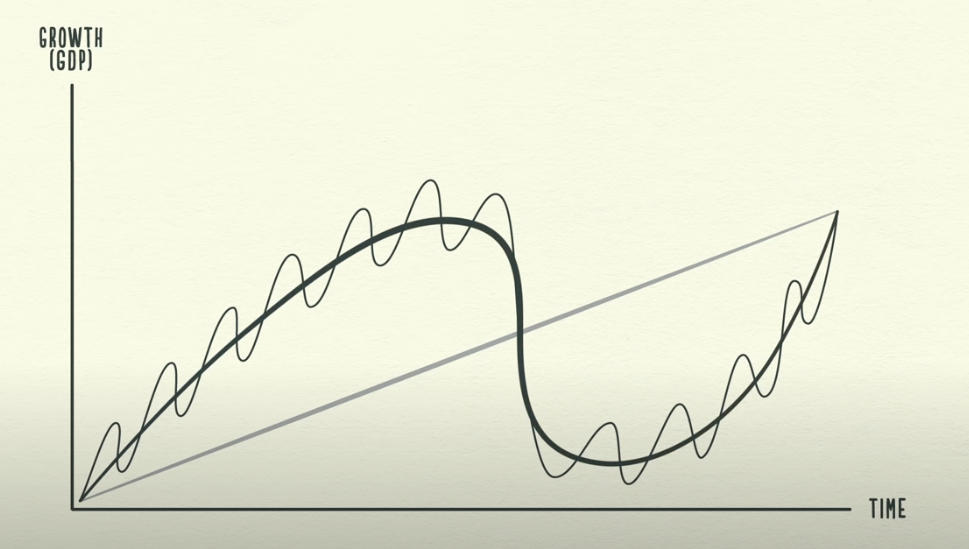

Dalio says that if you track productivity growth, it looks like a straight line and has increased at an average rate of around 2% over the last 100 years. It doesn’t fluctuate because as Dalio points out, we don’t just forget how to be productive during certain periods.

However, the economy doesn’t act like a straight line that gradually goes up. In reality, it goes up and then comes back down (booms and busts).

To understand that, Dalio says we have to look at credit.

Step #3 Understand Debt and Cycles

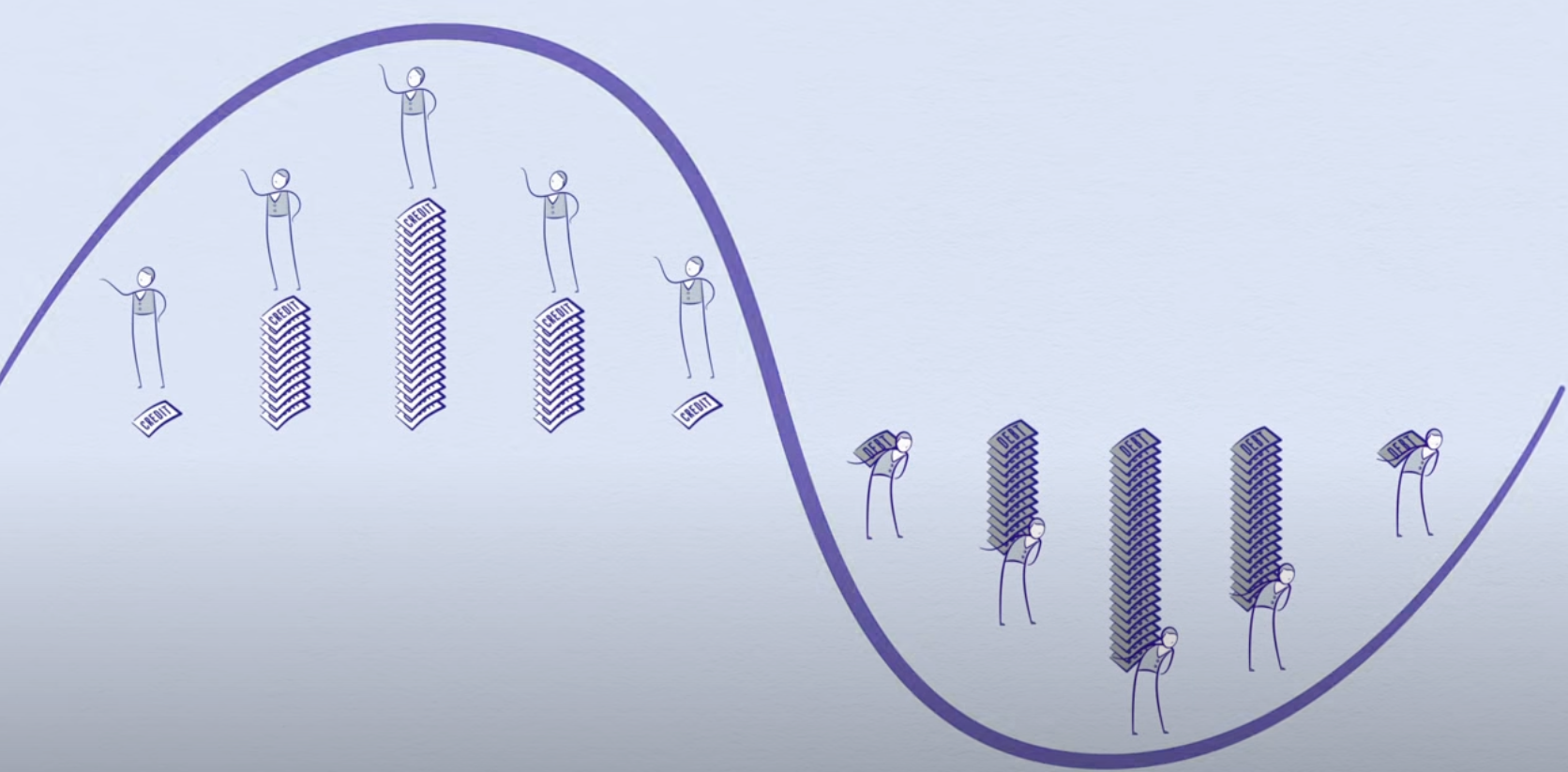

Another name for credit is debt. If you've ever borrowed money for a car or house, you know what debt is. Debt includes a lender and a borrower. The borrower needs money to buy something and the lender will loan them money if the borrower promises to pay it back at a later date (plus interest.)

If there was no debt in the economy, someone would have to earn the money FIRST then buy what they wanted after they earned it. Income (and therefore spending) would be directly tied to how much you produce or work.

Dalio says that that debt isn’t bad, but it can be if burdens become too large. Debt can be good when it is used to be more productive. Like when you have to borrow money for your initial batch of lemons.

BUT when it funds overconsumption, it creates a burden.

Let's look at an individual perspective for simplicity (even though it can apply to businesses and governments as well). In order for someone to buy something they can’t afford today, they have to spend MORE than they currently make. So spending is higher than their income.

At the same time, they are promising to pay that amount back (plus interest) at a later date. So this also means they need to spend LESS than they make in the future to pay it back. So at some point, spending compared to their income will go down.

Anyone who has a car or house payment knows what this looks like. Not only are they borrowing from a lender, but they are also borrowing from their future self.

This pattern is the first time we see how cycles are created on a small scale.

This cycle happens to an economy the same way it happens to an individual. Dalio uses an example to explain. From his book Principles for Navigating Big Debt Crises;

“If you understand the game of Monopoly®, you can pretty well understand how credit cycles work on the level of a whole economy. Early in the game, people have a lot of cash and only a few properties, so it pays to convert your cash into property.

As the game progresses and players acquire more and more houses and hotels, more and more cash is needed to pay the rents that are charged when you land on a property that has a lot of them. Some players are forced to sell their property at discounted prices to raise that cash. So early in the game, “property is king” and later in the game, “cash is king.” Those who play the game best understand how to hold the right mix of property and cash as the game progresses.

Now, let’s imagine how this Monopoly® game would work if we allowed the bank to make loans and take deposits. Players would be able to borrow money to buy property, and, rather than holding their cash idly, they would deposit it at the bank to earn interest, which in turn would provide the bank with more money to lend. Let’s also imagine that players in this game could buy and sell properties from each other on credit (i.e., by promising to pay back the money with interest at a later date).

If Monopoly® were played this way, it would provide an almost perfect model for the way our economy operates. The amount of debt-financed spending on hotels would quickly grow to multiples of the amount of money in existence. Down the road, the debtors who hold those hotels will become short on the cash they need to pay their rents and service their debt. The bank will also get into trouble as their depositors’ rising need for cash will cause them to withdraw it, even as more and more debtors are falling behind on their payments. If nothing is done to intervene, both banks and debtors will go broke and the economy will contract. Over time, as these cycles of expansion and contraction occur repeatedly, the conditions are created for a big, long-term debt crisis."

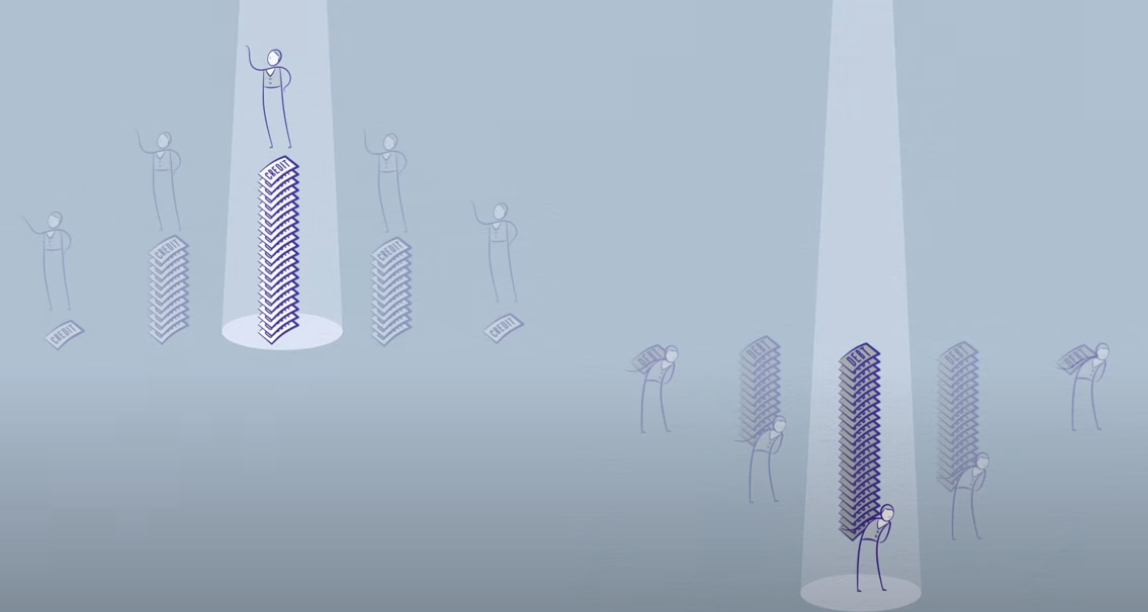

So how much debt is there?

When people buy goods or services they use money. However, much of what people consider to be money is actually debt. At times debt in the economy is over 15 times greater than the money available to pay it back.

An example...

At the time of his How the Economic Machine Works video on Youtube (around 2013) there was 50 trillion dollars worth of debt and only around 3 trillion dollars of actual money. At the end of 2020, there was over 80 trillion dollars of debt(1) in the economy.

Similar to the individual, just as the cycle went up because of increased spending in the present which led to higher prices and more jobs - If funded by debt, the cycle must also come down when people have to spend less than they earn to pay it back.

When someone cuts back their spending, they are also cutting back on someone else’s income (going back to the transaction example). As this happens the previous growth now starts to contract in the opposite direction.

There are numerous cycles like this, they are typically called recessions and most likely you don’t feel them for too long because the government has a way of trying to manage these cycles.

Step #4 Understand the Monetary System

There are a few major concepts that help understand how smaller cycles turn into larger ones. We're going to cover Monetary Systems, Federal Reserve, Interest Rates, and Printing Money.

Monetary Systems

Dalio covers two types of systems in his Template for Understanding Essay;

“Basically, there are two types of monetary systems: 1) commodity-based systems – those systems consisting of some commodity (usually gold), currency (which can be converted into the commodity at a fixed price) and credit (a claim on the currency); and 2) fiat systems – those systems consisting of just currency and credit.

In the first system, it's more difficult to create credit expansions. That is because the public will offset the government's attempts to increase currency and credit by giving both back to the government in return for the commodity they are exchangeable for.

As the supply of money increases, its value falls; or looked at the other way, the value of the commodity it is convertible into rises. When it rises above the fixed price, it is profitable for those holding credit (i.e., claims on the currency) to sell their debt for currency in order to buy the tangible asset from the government at below the market price.

The selling of the credit and the taking of currency out of circulation cause credit to tighten and the value of the money to rise; on the other hand, the general price level of goods and services will fall. Its effect will be lower inflation and lower economic activity.”

In simple terms, commodity-based systems require that the amount of money and credit is attached to something and in a fiat system it is not attached to anything. The United States has been on both, at times we have been on the “gold standard” tying currency creation to a gold supply and currently we are on a “fiat system.”

Dalio explains that governments and countries switch due to feeling the consequences of each. More from his essay;

“Governments typically prefer fiat systems because they offer more power to print money, expand credit and redistribute wealth by changing the value of money.

Human nature being what it is, those in government (and those not) tend to value immediate gratification over longer-term benefits, so government policies tend to increase demand by allowing liberal credit creation, which leads to debt crises.

Governments typically choose commodity-based systems only when they are forced to in reaction to the value of money having been severely depreciated due to the government’s “printing” of a lot of it to relieve the excessive debt burdens that their unconstrained monetary systems allowed.

They abandon commodity-based monetary systems when the constraints to money creation become too onerous in debt crises. So throughout history, governments have gone back and forth between commodity-based and fiat monetary systems in reaction to the painful consequences of each.”

The Federal Reserve

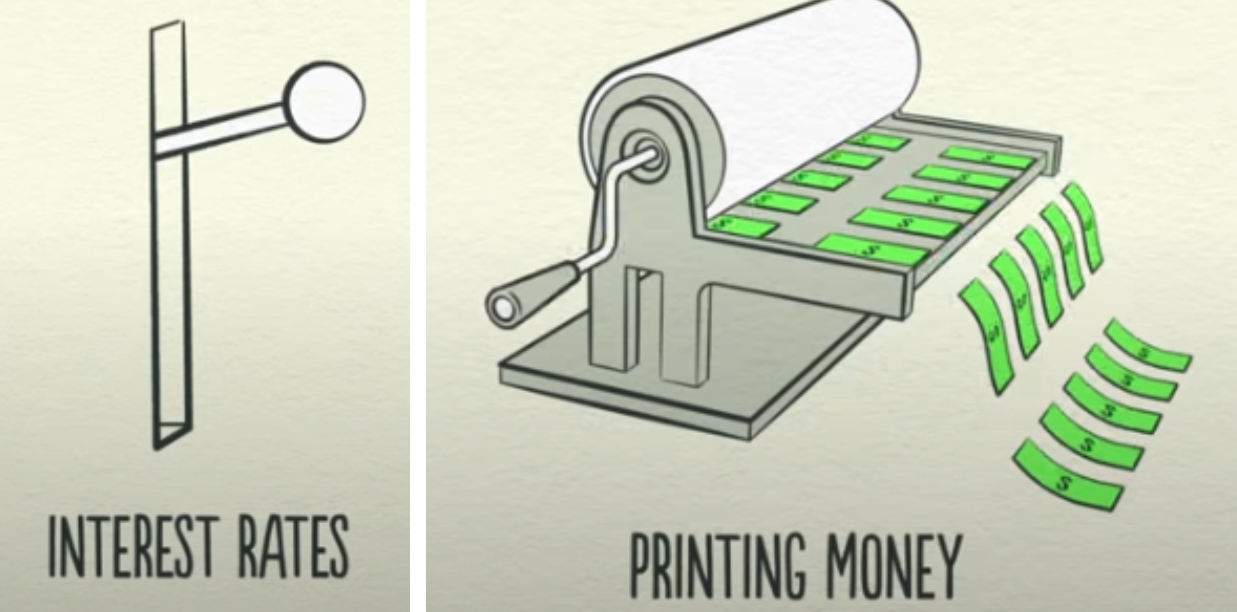

The Federal Reserve or “Fed” was created in 1913 to control the money supply with the goal of creating a more flexible and stable financial system. It attempts to do this in two major ways. Controlling interest rates and printing money.

Interest Rates

The Fed will increase or decrease interest rates depending on what part of the cycle they think we are in. When spending is high (inflation), they want to raise interest rates to lower spending. When spending is low (deflation), they want to lower interest rates to bring spending back up.

If interest rates are low, more people borrow because they can pay it back with less interest which increases debt in the economy. If interest rates are high, fewer people borrow because it's more expensive to pay back which decreases debt in the economy.

An example from the real estate market.

When interest rates are low, more people borrow money so they can buy a house. When this happens, the cost of houses increase because there is more money in the market compared to the number of houses on the market.

When interest rates are high, fewer people borrow money and the cost of houses decrease because there is less money in the market compared to the number of houses on the market.

The Fed also dictates how much banks can loan out compared to what they have on hand. This can be as high as 15:1 (4) which means they loan out way more money than they have in deposits.

Printing Money

The actual printing is the same way anything else gets printed.

During times where money is tied to a commodity such as gold, to increase the money supply the Fed would have to get more gold, which is not an easy thing to do. On a fiat system, all the Fed has to do is print.

The Fed can only buy financial assets. So it can’t directly pass out money from a helicopter. It buys bonds from the public to get money into private banks and businesses AND it also buys government bonds to get money into the government.

So as you can see, the Fed has a lot of tools it uses to influence how much spending is happening in the economy. This helps the economy pick back up when it slows down. Dalio says these smaller cycles (or recessions) happen every 5-8 years and spending typically resumes without too many problems.

However, cycles get bigger and bigger because according to Dalio (Debt Crises);

“Throughout history only a few well-disciplined countries have avoided debt crises. That’s because lending is never done perfectly and is often done badly due to how the cycle affects people’s psychology to produce bubbles and busts.

While policy makers generally try to get it right, more often than not they err on the side of being too loose with credit because the near-term rewards (faster growth) seem to justify it. It is also politically easier to allow easy credit (e.g., by providing guarantees, easing monetary policies) than to have tight credit. That is the main reason we see big debt cycles.”

Step #5 Understand "Bubbles"

Dalio gives 7 characteristics of bubbles (Debt Crises):

- Prices are high relative to traditional measures

- Prices are discounting future rapid price appreciation from these high levels

- There is broad bullish sentiment

- Purchases are being financed by high leverage

- Buyers have made exceptionally extended forward purchases (e.g., built inventory, contracted for supplies, etc.) to speculate or to protect themselves against future price gains.

- New buyers (i.e., those who weren’t previously in the market) have entered the market.

- Stimulative monetary policy threatens to inflate the bubble even more (and tight policy to cause its popping)

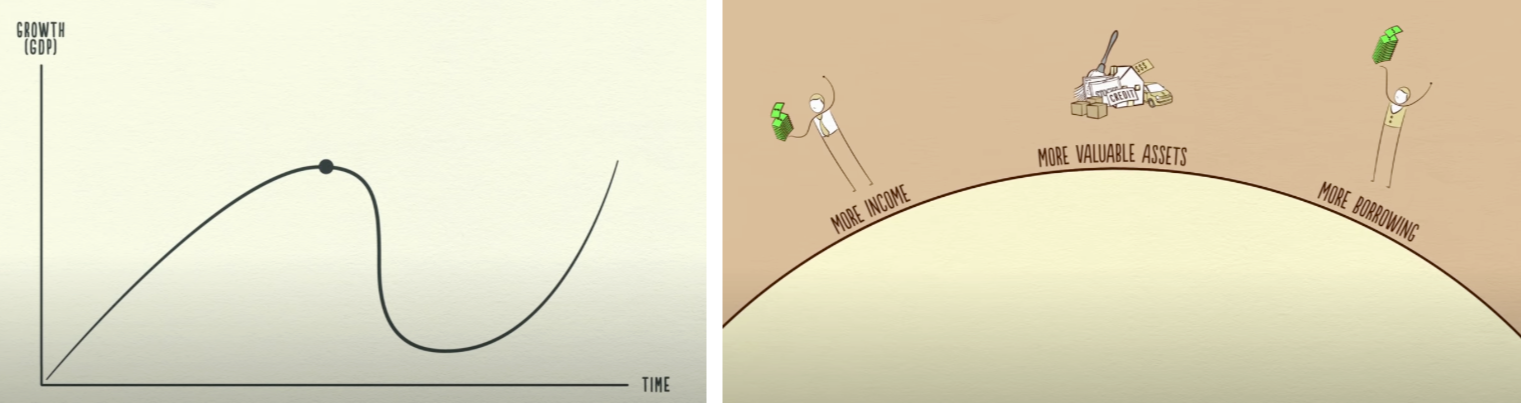

As the Fed stimulates the economy out of recessions, each new cycle starts with more debt than the previous cycle.

Why?

Because when conditions improve and things are going well, people continue to prioritize spending over paying back debt.

Everyone thinks the economy is hot, not paying attention to the debt burden that is also growing. When this happens for multiple cycles the whole economy eventually turns into a “bubble.” Which eventually pops.

Let's go back to the lemonade stand. You borrow money to purchase lemons and equipment for your business. This helps you generate sales and you have money coming in. When the economy is in a recession, you have less income coming from sales which means less money to pay your bills - including the money you borrowed.

Just as you start to feel the pinch, the bank you use has lowered interest rates which means you can borrow more money for less. You add more debt to your balance sheet but at least you can pay your bills.

As business picks up, it makes more sense to use the additional income to buy more equipment, expand, or even buy some luxuries instead of pay back what you borrowed. In fact, interest rates are so low, why would you pay more than you have to each month?

Sales slow down again due to another recession but this time interest rates can't be lowered and you have a mountain of debt on your hands. The value of your business has dropped as everyone is trying to sell their assets to pay bills.

You lay off your employees making it harder for them to pay their bills and tell the bank that was counting on your payments as their income that you won't be able to pay what you owe.

This is similar to what happens when debt burdens get too big, and the Fed can no longer lower interest rates because they are already at zero after multiple cycles.

Each cycle created more debt than the previous cycle and now the economy as a whole has is upside down. There is way more debt than the money available to service it.

The economy enters a depression.

Step #6 Understand Depressions

In 1923, Germany was at the peak of one of the worst hyperinflation examples in history.

Printing money to repay debts caused by WW1, inflation spiraled out of control and prices increased 387 BILLION percent. To buy a loaf of bread, you would have needed 6 billion marks (German Dollar) which was the same amount as the entire money supply 10 years earlier.

There are two main types of depressions that economies can fall into (Debt Crises);

“In deflationary depressions, policy makers respond to the initial economic contraction by lowering interest rates. But when interest rates reach about 0 percent, that lever is no longer an effective way to stimulate the economy. Debt restructuring and austerity dominate, without being balanced by adequate stimulation (especially money printing and currency depreciation).

In this phase, debt burdens (debt and debt service as a percent of income) rise, because incomes fall faster than restructuring, debt paydowns reduce the debt stock, and many borrowers are required to rack up still more debts to cover those higher interest costs.

As noted, deflationary depressions typically occur in countries where most of the unsustainable debt was financed domestically in local currency, so that the eventual debt bust produces forced selling and defaults, but not a currency or a balance of payments problem.

Inflationary depressions classically occur in countries that are reliant on foreign capital flows and so have built up a significant amount of debt denominated in foreign currency that can’t be monetized (i.e., bought by money printed by the central bank). When those foreign capital flows slow, credit creation turns into credit contraction.

In an inflationary deleveraging, capital withdrawal dries up lending and liquidity at the same time that currency declines produce inflation. Inflationary depressions in which a lot of debt is denominated in foreign currency are especially difficult to manage because policy makers’ abilities to spread out the pain are more limited.”

The main issue that people, businesses, and government need to deal with is bringing down the debt burden in a way that spreads out the pain and doesn't make the problem worse.

There is no easy way out but Dalio says there are 4 levers that policy-makers can and will use to bring debt levels down.

4 Levers

- Austerity (spending less)

- Debt defaults/restructurings

- The central bank “printing money” and making purchases

- Transfers of money and credit from those who have more than they need to those who have less.

Dalio argues that when any of these methods are overused, a depression can continue to spiral uncontrollably and bigger problems emerge. When this is done correctly and well balanced, debt can slowly be dissolved and the economy can slowly improve. He calls this a “beautiful deleveraging.”

Even when handled in the best possible way, it could still take 10 years for things to get back to normal. Which is called a lost decade.

Conclusion

For the most part, Dalio gives a measured and objective approach to evaluating and explaining how the economy works. I think this is in part because his job is making money for his clients and he needs to focus on how things are vs how they should be.

With that being said he does give 3 tips for how to avoid economic problems:

"1) Don’t have debt rise faster than income because then your debt burden will crush you.

2) Don’t have income rise faster than productivity because then you will become uncompetitive.

3) Do all that you can to raise your productivity because in the long run that’s what matters most."

I highly recommend diving into Dalio’s work (I included sources at the bottom). Along with his 40 years of experience building one of the largest hedge funds in the world (which he started out of his apartment) he provides a ton of material to show how he arrived at his conclusions.

Dalio also writes in his book;

“To be clear, I appreciate that different people have different perspectives, that mine is just one, and that by putting our perspectives out there for debate we can all advance our understandings. I am sharing this study to do just that”

That might be his best advice.

- FRED Economic Data

- Ray Dalio A Template for Understanding Essay

- Ray Dalio How The Economic Machine Works Video

- Ray Dalio Principles for Navigating Big Debt Crises (free PDF)

- New Yorker Article

- Animation from How the Economic Machine Works Video